Uganda Telecom Limited: President Museveni letter to Hon. Evelyn Anite – “Re: Audit of Uganda Telecommunications Limited” (16.07.2019)

Since March 2017, the Uganda Telecom Limited (UTL) have been struggling, it started even before then, but at that time. The state started to intervene, by the next month in April 2017. The state had already put the company under provincial ownership. Meaning, that the state took it over and has tried to find new ownership of this company. Something it hasn’t succeeded in. This all happened because of the Libyan crisis in 2011 and the frozen accounts of Libya Post Telecommunications & IT Company (LPTIC), which had a majority ownership in the UTL until that point. However, they didn’t get all out before March 2017. Even as there was a set-up a new board in the Company in fall of 2016. Even, with all of this, the UTL continues to live, but by mere state injections and not because it is viable for business.

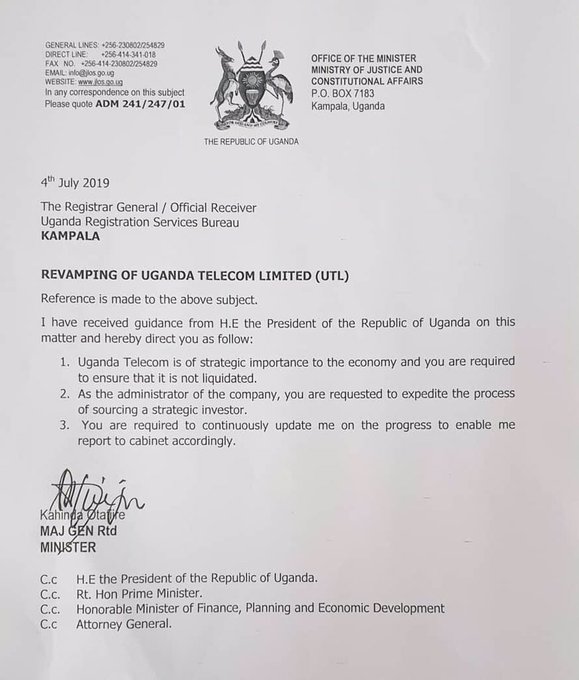

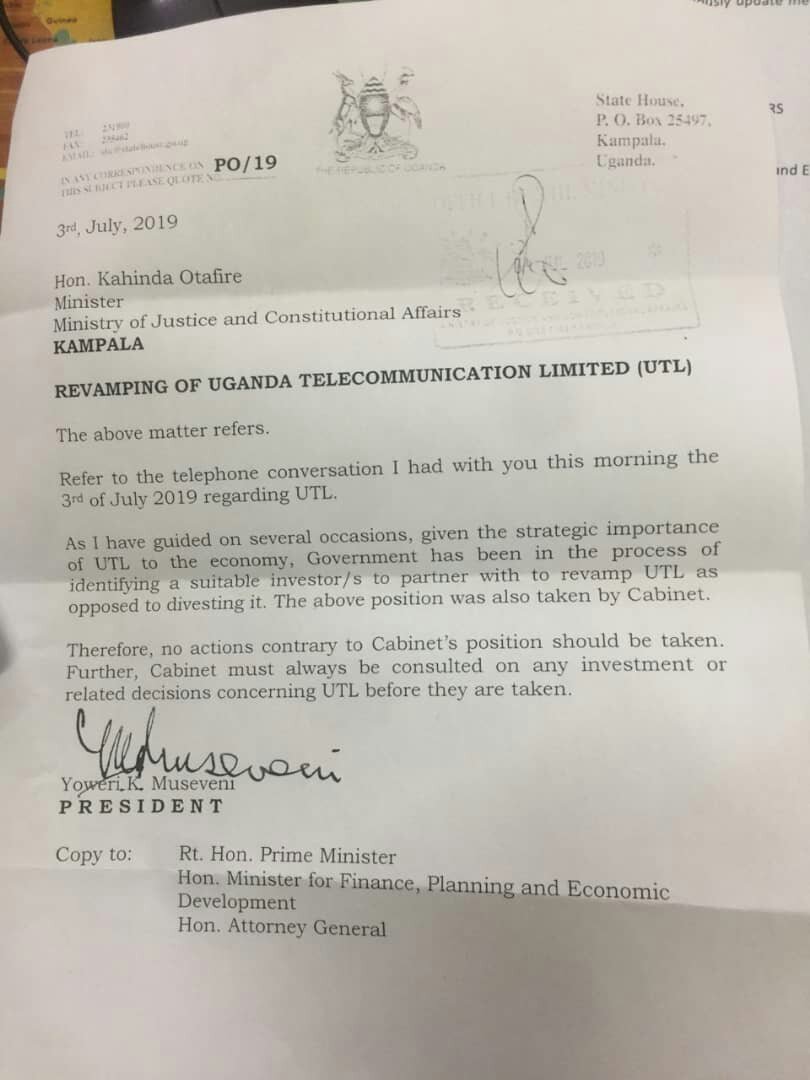

Even after a year in May 2018, the Cabinet announced that they were looking for new owners, alas, meaning that the state wouldn’t have the major stake in the company. Why I am saying all this? Well, the news this week that Minister Evelyn Anite and government sources states this:

“The source added that the government had created incentives to make the company more attractive. They include managing the backbone, wiping all the liabilities off the balance sheet, and that the government would take responsibility for the pension liability of more than Shs 30 billion to former UTL employees. Other liabilities that the government would take care of include the regulator’s fees and taxes. “All these wipe off the balance sheet and handed it [UTL] to you, clearly you can start from a clean slate.” the source said” (URN – ‘Gov’t offers to pay Shs 500bn UTL liabilities’ 20.04.2019, link: https://observer.ug/news/headlines/60467-gov-t-offers-to-pay-shs-500bn-utl-liabilities).

With this in mind, the state would clean the slate of the company, an embattled one who is fighting in a competitive market. Where it is directly competing against the mighty MTN and Airtel. Therefore, the UTL needs an decent upgrade, as it has been in a stalemate for years now. Where the lack of investment in the company and the debt it have already.

We can clearly see that the company is not so viable. The lack of interest and value is shown as the President even needed to direct the state ministries to use the UTL Internet Services and mobile phone services by a letter in January 2018. That is why, a year after that, the government sources are trying to connect it even more and juice it up. Even if it has little to offer.

The UTL doesn’t look solid or offering something of strong value for a buyer. As it has a strong competition and they are on point when concerning the telecom infrastructure, which the UTL haven’t the ability to afford to do or invest in. Therefore, the next owner has to pick up, where the Libyan owners left off. Since, the state haven’t done anything else, than keeping it alive. Peace.

Again, the investor and mineral licensing powerhouse in the Democratic Republic Congo, Dan Gertler is even more under fire after the revelations of his illicit trade during the recent years. Now, the formula and the amount of cash he gets from the foreign mineral extraction companies are paying for their passage to him. This as the deals between Getler and Kinshasa authorities are left in the dark. Whatever deal they have, certainly Getler is earning fortunes without doing more, than being connected to the Joseph Kabila government.

This report shows important facts and also bring certainties of the assumed fortunes made by Gertler, even as he is sanctioned and his corporations. Clearly, the mineral extraction is profitable in the midst of insecurity and civilian despair in the republic. While the businesses and the affiliates are eating, the public are fleeing militias and the army itself. The state is not serving the public, but the companies and the persons who has secret deals with the government. It is vicious and the international community let them, even as it is sanctioned, the acts are still appearing and has the ability to earn on it.

“Based on a number of assumptions, Resource Matters estimates the royalties to the Gertler-affiliated companies can be expected to amount to about $110 million for 2018 and nearly $100 million for 2019. This means that Gertler risks losing about $270,000 in revenue from Glencore’s operations per day. That is nearly twice as much as the world’s best paid soccer player, Lionel Messi, makes at Barcelona” (Resource Matters, P: 6, 2018).

“Glencore therefore has to balance the risk of increased pressure in Congo versus the risk of ending up on the U.S. sanctions list. This means that the royalty payments constitute a significant risk, whether they stop or continue. Investors should be able to know how Glencore will deal with this going forward. U.K anti-corruption organization Global Witness has repeatedly lamented the opacity of Glencore’s royalty payments to Gertler’s companies and called for better disclosure” (Resource Matters, P: 8, 2018).

“This conclusion was somewhat hasty. Gertler’s gold companies do not explicitly feature on the sanctions list, but that in itself does not matter. Under the U.S. Treasury’s so-called 50%-rule, any company owned at least 50% by a sanctioned entity is considered, per se, sanctioned because it is deemed to be “blocked property” of the sanctioned person. Both Moku Goldmines and Société Minière de Moku-Beverendi are at least 50% owned by Fleurette, a sanctioned entity, and should be considered sanctioned, too. In addition, the fact that no payments are made to Gertler does not shield Randgold from the risk of being sanctioned. The U.S. Treasury could qualify Randgold’s exploration activities at Moku-Beverendi as ‘material support’ to a sanctioned entity and impose sanctions on Randgold” (Resource Matters, P: 9, 2018).

Gertler might be in hot-water and the Kabila government might have decisions to make concerning their alliance. Still, the trades and contracts has been made, if the Kabila government suspend and revoke it, they might have to pay a settlement. While wait for a new company or middle-man to secure a grand deal for the licensing. We can question if the loyalty will be there, as long as the sanctions might hit the companies who works with Gertler. Because, they do not want to lose the profitable and secure delivery of the cobalt and other minerals in the Republic.

Surely, Getler don’t want to miss his winning ways and his double earnings of Messi. He want it and doesn’t care about how. Getler just continue to score and get contracts, which makes his giant fortune. It is by the blessing of his connections in Kinshasa. Peace.

Reference:

Resource Matters – ‘The Global Magnitsky – Effect How will U.S. sanctions against Israeli billionaire Dan Gertler affect the DR Congo’s extractive sector?” (February 2018).