“The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little.” – Franklin D. Roosevelt

Well, this time in history will be remembered, in the times that the multi-national corporations have most of them fled their regional scenes and put their headquarters and main operations into tax havens. Therefore, with this in mind, the states and republics that actually is where they make the profits get less tax and get fewer monies to spend on public services. That does not make them poor, but smart someone might say. This is legal and the openness of the economies let them do it, but to be frank, we should question this big giant corporations for their fleeing fortunes abroad.

The corporations are not alone in all of this, the rich people themselves cannot sustained this, they cannot afford to pay reasonable taxes, and they need tax-relief so they can salvage their Monte Carlo and their Lamborghini’s. They have their massive mansions and stalls of cars, but cannot pay the percentages on the tax as ordinary working-class do. In addition, the working-class use decades on end to pay down the mortgage on the house and loan on their Ford Fiesta. If they can even afford a house and a car at his point.

The American enterprise and experience is really seeing it, as they plan to repeal and replace Obamacare, because the wealthy are too broke or to selfish to help the working-class who made them rich. That the working-class and industrial worker are falling behind as new schemes to outrun their possibilities. The corporations and the believers of free economies want more flexibility, but do not give equal wages or compensations. Therefore, the loser in the transactions are the workers and not the companies. Secondly, the states earn less without added productivity.

It is naive that the businesses care about other things than the bottom-line is vicious, like the wealthy have the capacity to share the spoils, which they have earned on the commoners and the citizens. Therefore, the spoils, which in some industries entails sweatshop workers and exports to the Western hemisphere with grand profits for the clothing and appeal giants. Something that the workers in Bangladesh or Pakistan doesn’t see anything delivered back, than a filthy industrial complex and possible health hazards for their hours work on end for a lousy T-shirts.

The others are the ones who are doing mining and extraction for the technology and IT businesses that has no issues with the illegal and militias taking controls over mining fields and black-market trading of rare earth minerals or cobalt for that matter. As long as the giant companies trading computers, smart-phones and whatnot get their profits. Certainly, the CEO and other leaders in the corporations should worry of the implications and the lives destroyed while their businesses are earning loads of monies. There should be some sort of certification of the weak trading points; if they knowingly paid, some of the monies on technology could fund militias and illegal armed conflicts.

This is real poverty, that we have systems, salary structures and imports that hurt local areas, while the businesses earn fortunes, that again is flying on the merry to a tax haven in the pacific through a shell-company set-up by lawyers in Panama. In addition, this is legal and just, by law and in society. That the same companies telling their workers that they cannot afford more wages, since they have to stack millions upon millions in the British Virgin Island. So that the shareholders and stakeholders can earn profits for the toils and sweat of fellow workers.

So when I hear that the workers cannot ask for bigger salaries, while the states and republics create tax-holidays and tax-breaks, incentives for “investments” while the big-men are doling away vast fortunes in the middle of the day. Like a legal heist, a theft of both tax and salary, the salaries that could be used more in the system to gain growth, and secondly the added tax that could build roads and infrastructure that the company could need. However, hey, we do not need proper roads and wages, as long as the rich can travel to Monaco and St. Tropez whenever they feel like it. We are foolish to think otherwise!

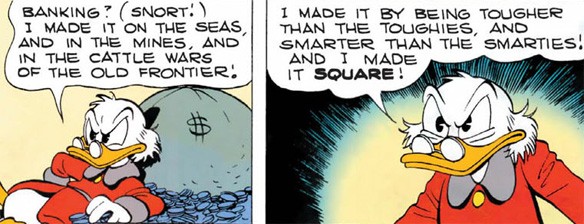

When you hear that the rich has to get tax-breaks and their taxes cut, know that they are poor in spirit and heart. They may have vast fortunes and riches, but their hearts are empty. They do not see the problems of the day-to-day basis of the ones creating their empires. They do not see the people who buys their labeled products and services. They only see the bottom-line, the empty shells companies’ accounts and the schemes to hide the monies. That is because these wealthy people are so poor; they cannot afford to be like the rest of us.

The wealthy are so poor, they are so poor that they have to avoid taxes or pay taxes, because if they were paying taxes they would be like us. They would have the same responsibilities and have the same understanding of welfare and public services. Therefore, since they do not need the public service, they can afford to travel abroad for health-care; they can afford to send their kids to private schools and can afford to import goods. Then they do not need the support and the base line of the republic or the state. Like you and I do. Therefore, with that in mind, which is why they are so poor. Their poverty is in the mind and in their spirit; they cannot be a part of us, because they want to shield themselves from us. Still, earning our monies and taking our cheap labor, no problem!

This poor people need help, they need guidance, their riches might fall out of their hands, might be lost in coup d’état or worse than they get bankrupt. Than they need the states to salvage their business or their bank, with our tax-monies, without any hesitation, but when it was booming. That was the time they had no need of paying taxes or paying amends to the state through the regulations. Like we do and pay for our right to live and use the needed services of the states.

In these interesting times of ours, we have the riches seeking to pay-less, while the working-class is footing the bills or trying too. While the republics and states make it harder for public service and make it more expensive to pay for the needed services. This are all made in the hands of the wealthy and the multi-national corporations, without considering the implications of the commoner, the working-class nor the middle-class that are all sinking on the behalf of the rich. Certainly, the belief that the trickle-down economy should be a project avoided, but to many still have faith in the paradigm. While very, few have any social mobility or have the capacity to go from one class to the next. Peace.