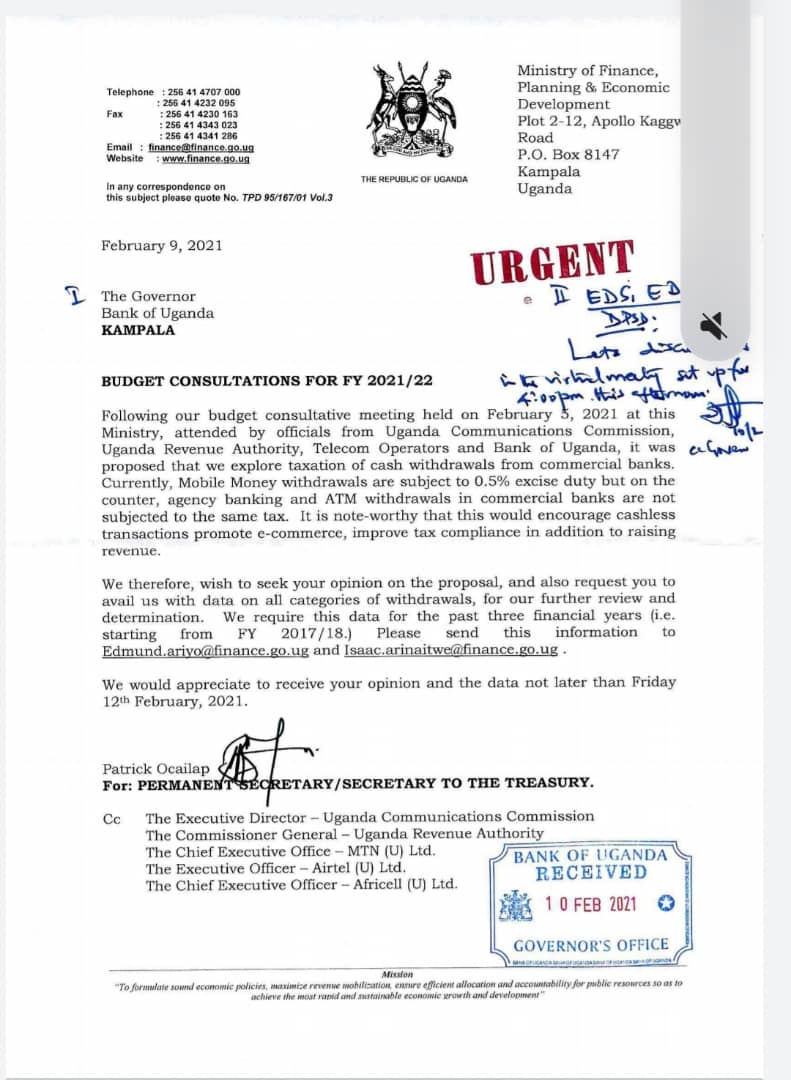

The Ministry of Finance, Planning Economic Development (MoFPED) is preparing a tax on every cash withdrawal from ATMS or Commercial Banks. This means every time someone takes out cash from their accounts. The customers i.e. the citizens have to pay the state a fee to access their money. Just like they do with the mobile money transactions. That’s why the state is proposing this.

This is an easy way to access more funds without adding any value to the monetary market. The state will not do anything, but adding a fee. A percentage on every single transaction. In the meanwhile, they will also deplete funds from the citizens. As the citizens have to calculate every transaction to ensure they are paying less taxes. That is what people does when they want to ensure they get most value out of the money. Which will be standard.

The manner of doing this. Is in a state where there is already lots of cash and money in circulation. The Republic is built with cash based economy and need for cash itself. That is why in some ways this will even be a double tax. Especially for the ones having first mobile money transfer to family members and loved ones. They are first paying a fee to send it too them, which is the Mobile Money Tax. Then the person receiving the Mobile Money will have to pay either at a bank or at ATM the Cash Withdrawal Tax. In this way the state is getting paid twice before the money is even getting in circulation.

I wonder, if the MoFPED have thought of the consequences of this? Has the state considered the implications for the citizens? Or are they only trying to figure out new ways to cash in on every citizens. So that their behaviour and need for money will cost them.

Because, it is normal that foreigners or aliens are paying to take out money at a ATM abroad. They usually pay a transfer fee between their currency and the Ugandan Shilling. That is making sense and the bank also takes a fee for doing so. A tourist knows this and accepts it, as it is a way of easily access and securing local currency. However, what the state is proposing is paying a tax to access your own money.

The state is billing people for withdrawal of cash. In essence the state will take money for service rendered for printing money. They are billing the public for having circulated coins and bank notes. Since, they are taxing every transaction and that’s really ill. This sort of enterprise isn’t growing the tax-base, but taking away more funds from circulating. The more you tax, the more funds you are depleting from the system. In the end you have a evil circle where all taxes are overburdening the citizen. In such a manner, that they start to do all business and transactions on the black-market to save money. That is when the state loses out and cannot access these transactions at all. This because they have found other means of moving money and doesn’t want to pay added taxes on their needed funds.

The more these taxes are put forward. The more funds are taken away from the ones who needs them. This is all taken away from the citizens before they get to access the money. Either it is mobile money or taken from their account through a withdrawal. That should worry the Representatives and the ones making laws. The amount of 0,5% doesn’t sound like a lot, but imagine that on every single transaction or withdrawal. That will be huge sum and be a costly endeavour. Peace.