The Economic Policies of any United States administration are usually bound by the people that are running two key positions; these are Secretary of Treasury and Secretary of Commerce. The Economy is bound by the decisions these ones do. This here will prove what kind of administration that Trump will run and what kind of regulations of trade, business and economy in general. Therefore the picking of personnel is central to how the state of affairs at the top of the food-chain in Washington.

Donald Trump the Presidential-Elect that has been all and mighty on draining the swamp. So he proves that it was just words during the campaign to sell to his supporters, he even pledged this earlier in the year:

“We have to give new voices a chance … so we can have a government that works again and can function properly …” Trump said” (Hughes, 2016).

Draining the Swamp:

“There is another major announcement I am going to make today as part of our pledge to drain the swamp in Washington. If I am elected President, I will push for a Constitutional Amendment to impose term limits on all members of Congress” (…) “Decades of failure in Washington, and decades of special interest dealing, must come to an end. We have to break the cycle of corruption, and we have to give new voices a chance to go into government service. The time for Congressional term limits has arrived” (…) “Not only will we end our government corruption, but we will end the economic stagnation” (Trump, 2016).

We will first see what the Treasury are supposed to do and what the department will do:

“Treasury’s mission highlights its role as the steward of U.S. economic and financial systems, and as an influential participant in the world economy” (Treasury.gov – ‘About – Role of Treasury’). So the Secretary of Treasury is important for the financial system, therefore it’s important to look at the nominee. So we have to look into the nominee who has influence of the financial systems.

Also, we have to see what is special about the Department of Commerce: “The Department works with businesses, universities, communities, and the Nation’s workers to promote job creation, economic growth, sustainable development, and improved standards of living for Americans. Through its 12 bureaus and nearly 47,000 employees located in all 50 states and five U.S. territories and more than 86 countries worldwide, the Department administers critical programs that touch the lives of every American” (Commerce.gov – ‘About Commerce’). So we can see the importance of the person leading these 12 bureaus that should make it possible to create jobs and commercial business in the United States, therefore the person leading here has to know how to improve the economic growth.

With this knowledge the persons acts before and their economic framework together with the economic platform; that means their faith in the markets or the regulations. That he will give way to free regulations for the financial markets instead of regulating them.

Steve Mnuchin is the nominee for Secretary of Treasury:

“Mnuchin worked at Goldman Sachs for seventeen years, where he eventually became an executive vice president. According to the Wall Street Journal, he left in 2002 “at the age of 39 with a reported $46 million stake in the bank.” He was recruited by his Yale roommate, Eddie Lampert, to join ESL, a hedge fund, as vice chairman. A few months later, he jumped to SFM Capital Management as its CEO. But within a few months he changed jobs again, leaving SFM to co-found Dune Capital with his former Goldman colleagues Daniel Neidich and Chip Seelig” (…) “In 2009, Mnuchin helped assemble a group of investors (including computer capitalist Michael Dell, financier George Soros, private equity investor Christopher Flowers, and hedge fund titan John Paulson) to buy IndyMac Bank from the Federal Deposit Insurance Corporation (FDIC) as part of a sweetheart deal. They renamed it OneWest Bank and kept its headquarters in Pasadena” (Dreier, 2016).

Relativity bankrupt:

“Relativity explicitly blames the bank, founded by Steve Mnuchin, who until recently was one of studio founder Ryan Kavanaugh’s best friends and a company director, for violating bankruptcy procedures and for delaying the release of a movie recently considered to be the studio’s savior, a letter and an email from the company obtained by The Post reveal” (…) “ OneWest’s hoovering up of the $50 million, revealed in court papers, included $32 million drained from the studio’s library and $17.9 million from two other accounts” (…) “The bank’s actions placed Relativity in a precarious financial state, forcing it to largely “stop paying many vendor bills, to postpone production of certain film projects and to postpone the release of certain completed films,” Blackstone’s Tim Coleman, Relativity’s financial adviser, said in court papers” (McCaulay, 2016)

Foreclosure from OneWest:

“According to Gudiel, when she tried to make the $2,500-a-month mortgage payment two weeks late in November 2009, OneWest refused the payment and instructed her to pursue a loan modification, a long process that ultimately ended in rejection in January” (…) “OneWest referred questions to the public relations firm Sard Verbinnen & Co., which said that Fannie Mae, which holds about one-third of the mortgages in the country, had not authorized them to modify the loan” (… ) “OneWest is pleased that it has been able to work with Fannie Mae, the owner of the loan, to authorize it to offer the Gudiels a loan modification that would allow the family to stay in their home,” the firm said in a statement” (Huus, 2011).

Fraud from his bank:

“While the Rigalis were negotiating on the mortgage modifications, IndyMac Federal Bank failed in what would be the fourth-largest bank failure in U.S. history. What was left of IndyMac was acquired in March 2009 by a Mnuchin-led group of private investors for $1.55 billion” (…) “The Rigalis’ court filings “alleged they were led to believe, by representatives of several banks over a period of years, that their $560,000 loan would be modified. They believed they had entered into several forbearance agreements with several but related banks.” (…) “Crandall wrote in his denial of the motion that “the facts before the court are sufficient to defeat summary judgment” of most of OneWest Bank’s assertions, and he concluded that the Rigalis produced enough proven evidence to show that they could prevail in a jury trial. OneWest quickly offered a settlement, sources said” (…) “Recent legislative measures “provide an important lens” for the court to look through, wrote Crandall in denying OneWest’s motion” (…) “The judge was referring to the banking practice of dual tracking, in which a borrower in default seeks a modification while the institution continues at the same time to pursue foreclosure. By the time the borrower learns what is happening, it is usually too late to prevent the foreclosure” (Blackburn, 2013).

Just as he has become the nominee certain board positions he had to give up:

“NEW YORK–(BUSINESS WIRE)–CIT Group Inc. (NYSE:CIT), cit.com, a leading provider of commercial lending and leasing services, today announced that Steven T. Mnuchin has resigned from its Board of Directors, effective immediately. His resignation follows President-elect Donald J. Trump’s announced intention to nominate Mnuchin as the next Secretary of the Treasury” (…) “On behalf of the entire Board, I want to thank Steven for his contributions to CIT,” said Ellen R. Alemany, Chairwoman and CEO. “Steven has been a valued member of our Board, and we wish him well in this monumental role.” (CIT.com, 2016). He also stepped down from being a board-member at Sears.

So the OneWest CEO Steve Mnuchin is becoming the Secretary of Treasury in the Trump Administration. He been a board-member in CIT and Sears, as well as been speculative in foreclosures in people’s homes as well as Relativity studio or Film Company became bankrupt because of the loans and structure of funding through OneWest. So this speculative actions can be assured of will happen, but not with just one hedge-fund Wall-Street banker bravado, but now with the economic policies as underlining from the newly nominated Munuchin.

Than we have the other nominee that will lead 12 important bureaus that is now being delegated through the financial heavy weight Ross; which also have long history on Wall Street.

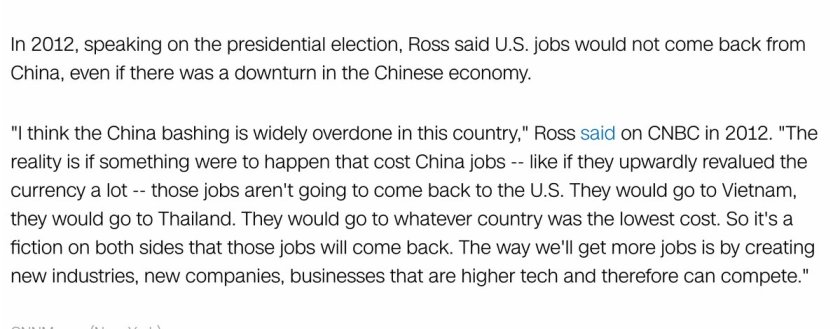

Wilbur Ross is the nominee for Secretary of Commerce:

Wilbur is another fellow with a spreadsheet that is impressive, but also sees the cynical side of the economy, where the importance of business is profits; not actually creating work. Therefore his nomination is more about securing equity is the reality than the person who actually earns those fortunes. Therefore the way he salvaged the businesses and made profits on them, as well as the reality of the man behind those transactions and how many settlements for fraudulent acts from his companies and subsidiaries. Here is a little look!

“Wilbur Ross is best known for his ability to find distressed companies and turn them around for a large profit – it is a talent that has given him an estimated net worth of more than $2 billion. And in recent years Ross’s sights have been firmly set on financial companies. Since 2008 he has invested a reported $1.8 billion into banks. But now he has had enough. NBNK Investments, the investment company in which Ross took a 30% stake in 2013 and that tried and failed to buy TSB from Lloyds, is closing. In 2010 NBNK had raised £50 million in an IPO with the aim of financing European banks. Six years later, it didn’t have a single investment to show for it” (Avery, 2016).

“WL Ross & Co. LLC, a Delaware limited liability company, is a private equity firm that was founded in 2000. WL Ross registered as an investment adviser with the Commission in April 2007. WL Ross is headquartered in New York, New York. Since 2006, WL Ross has been wholly owned by Invesco Private Capital, Inc., a subsidiary of Invesco Ltd., a publicly traded company (collectively, “Invesco”). WL Ross provides investment advisory services to the WLR Funds and other private equity funds, as well as to separately managed accounts and co-investment vehicles. According to its most recent Form ADV filing as of April 21, 2016, WL Ross has approximately $4.6 billion in assets under management” (Service Exchange Commission, 2016).

“Between 2001 and 2011, WL Ross adopted a Transaction Fee allocation methodology that resulted in WLR retaining a significant amount of those fees for itself rather than allocating them to the WLR Funds for the purpose of offsetting the management fee. Specifically, WL Ross allocated Transaction Fees that it earned from portfolio investments to the WLR Funds based upon their relative ownership percentages of the portfolio company without disclosing this practice. As a result, WL Ross retained for itself that portion of the Transaction Fees that was based upon co-investors’ relative ownership of the portfolio company, without subjecting such fees to any management fee offsets. WLR did not disclose to the WLR Funds and to the Funds’ limited partners that it would allocate Transaction Fees according to the above allocation methodology, and that WLR construed the ambiguous provisions in the relevant LPAs in its own favor rather than the WLR Funds’ favor. If WL Ross had instead adopted a methodology requiring the allocation of all Transaction Fees pro rata among the investing WLR Funds (and other WLR funds that also had offset provisions) and offset the WLR Funds’ management fees accordingly, the WLR Funds (and other WLR funds that also had offset provisions) would have received the benefit of all Transaction Fees received by WL Ross. WL Ross received approximately $10.4 million more in management fees using the selected methodology than if it had allocated Transaction Fees pro rata among the WLR Funds for management fee offset purposes during the relevant time period” (Security Exchange Commission, 2016).

Earning money on failing business:

“In May the board of NBNK, made up of private equity firm WL Ross & Co’s senior vice president Stephen Johnson, and Labour life peer and barrister Lord Brennan, voted in May to make the payment to WL Ross & Co for the “recovery of legal fees and other due diligence costs.” (…) “The vehicle’s most recent accounts revealed a loss for the year of £271,000, from a loss of £182,000 the previous year” (Bambrough, 2016).

“Billionaire investor Wilbur Ross has reached a deal to buy Nexeo Solutions Holdings LLC, a distributor of plastic resins and chemicals, for roughly $1.6 billion, including debt” (…) “Nexeo is currently owned by private-equity firm TPG, which purchased the company for nearly $1 billion from U.S. specialty-chemicals producer Ashland Inc (NYSE: ASH) in 2011. The deal is expected to be announced on Monday morning” (…) “WL Ross Holding will pay $500 million in cash and fund the rest of the purchase with debt, the sources told the newspaper. TPG will roll over some of its equity into the new public company, one of the people told the Journal” (DiSavino, 2016).

“The Securities and Exchange Commission said on Wednesday that the group failed to disclose its fee allocation practices, resulting in investors overpaying by $10.4m between 2001 and 2011. WL Ross was not allocating transaction fees to the funds to offset management fees, the SEC said” (…) “WL Ross also agreed to pay a civil penalty of $2.3m, but neither admitted to nor denied the SEC’s findings” (…) “We are pleased to have arrived at a resolution around historical management fee disclosure in a subset of our funds,” said Jeaneen Terrio, a spokesperson for Invesco, which bought WL Ross in 2006. “This resolution reflects a proactive approach to handling the matter and our commitment to exceeding the expectations of today’s private equity market.” (Sampson, 2016).

Fixing Irish Economy:

“As an investor in Bank of Ireland, it would be a surprise if Ross thought otherwise – after all he needs to recoup his investment and more. But he is one of the world’s most successful turnaround financiers – his involvement in the turnaround of over $200bn of distressed assets worldwide has earned him the nickname ‘king of bankruptcy’. So his words will be a boost to Ireland’s international standing” (…) “In the past few weeks of financial turmoil, Ireland has seen some faith in the international money markets restored, with 10-year bond yields down from 14% in mid-July to around 9%.” (O’Carroll, 2011).

So Donald Trump’s way of cleaning up the swamp is giving the idiom or a myth, because Wall Street connections with Washington D.C. cartels were not supposed to happen under the presidency. With the knowledge of the men he has picked in charge of the Economy, this proves that it was never a part of plan. If so Trump has a rare way of sending of the message with hiring and nominating Steven Mnuchin and Wilbur Ross.

These men have worked up fortunes and earned monies on the destruction of the American Dream. They have taken people’s hard-earned monies and created profits overnight. These men have used sophisticated limited liabilities companies, hedge-funds and transactions to earn monies on failed houses and companies. With ease the men and woman could be stifled even the government banks Fannie Mae and Freddie Mac and the foreclosed homes has even been a bargain. These men are supposed to create industry and the regulations for the finance industry. Together with the creations of consolidation funds and the roll-over money from the government; so that the debt could be staying longer as Mnuchin believes even can be put into 100 year bonds. That could create an unknown inflation of funds and also of the regulations of the combined currency in the market. Something that Wall Street people sees it as an opportunity.

Donald Trump has seeking to revamp the economy with men who are connected with the biggest investors of our time, with the families and using all kind of tricks to earn coins for themselves. Even the SEC has fined the companies of Mr. Ross for misbehaving with funds and with commissions, these men that has used ways of loop-holing the finance industry; the finance industry they now will steer. This can only be for the freedom of the giant companies and the wealth they have created in the market place on other people’s misery.

Trump has picked and nominated men who’s greed extend nearly no boundaries, these men will not drain a swamp or even follow up the promises on the campaign. They will continue and less regulates the economy. That might bring back the recession or even depression as the richer get wealthier and the poor will not become the middle-class.

These men has surely will secure the class there are set in and want to be part of. The one that they have been parts of and will secure the future of. These are not working-class friendly men who connect with the Indiana, Minnesota and Mississippi. So Trump clearly only a one-man show for the façade and not the real deal, sort of like a government acting on the Trump University philosophy: “You’re selling a feeling, not a product” and the same does the Trump Organization and now the Trump Administration.

The lie this time is the draining the swamp, the corporate parts of Washington D.C. politics and elites, as Trump chooses the same or even more wealthier businessmen who has more connections inside Wall Street and has more conflict of interest than before. The Trump Administration in the White House will be filled with men who have their business at heart and not the citizens who voted for him. Peace.

Reference:

Avery, Helen – ‘Banking: Wilbur Ross chases shadows’ (May 2016) Link: http://www.euromoney.com/Article/3551137/Banking-Wilbur-Ross-chases-shadows.html?copyrightInfo=true

Bambrough, Billy – ‘US billionaire investor Wilbur Ross picks up £280,000 from the ashes of NBNK’ (04.07. 2016) link: http://www.cityam.com/244546/us-billionaire-investor-wilbur-ross-picks-up–ashes

Blackburn, Daniel – ‘OneWest Bank pays 7 figures in mortgage fraud case’ (11.09.2013) link: https://calcoastnews.com/2013/09/onewest-bank-pays-7-figures-mortgage-fraud-case/

CIT.com – ‘CIT Announces Resignation of Steven T. Mnuchin from Board of Directors’ (02.12.2016) link: http://news.cit.com/press-release/corporate-news/cit-announces-resignation-steven-t-mnuchin-board-directors

Dreier, Peter – ‘The Worst of Wall Street: Meet Donald Trump’s Finance Chairman’ (10.05.2016) link: https://www.thenation.com/article/the-worst-of-wall-street-meet-donald-trumps-finance-chairman/

DiSavino, Scott – ‘Wilbur Ross to buy Nexeo from TPG for $1.6 billion: source’ (20.03.2016) link: http://www.streetinsider.com/Mergers+and+Acquisitions/Wilbur+Ross+to+buy+Nexeo+from+TPG+for+$1.6+billion%3A+source/11434492.html

McCaulay, Scott – ‘Controversial Film Financier Steven Mnuchin Joins Trump Campaign as National Finance Chairman’ (05.05.2016) link: https://filmmakermagazine.com/98428-controversial-film-financier-steven-mnuchin-joins-trump-campaign-as-national-finance-chairman/

Hughes, Trevor – ‘Trump calls to ‘drain the swamp’ of Washington’ (18.10.2016) link: http://www.usatoday.com/story/news/politics/elections/2016/2016/10/18/donald-trump-rally-colorado-springs-ethics-lobbying-limitations/92377656/

Huus, Kari – ‘Homeowner taps ‘Occupy’ protest to avoid foreclosure’ (17.10.2011) link: http://www.nbcnews.com/id/44908122/ns/us_news-life/t/homeowner-taps-occupy-protest-avoid-foreclosure/#.WEHO5fnhDIU

O’Carroll, Lisa – ‘Ireland will be ‘Celtic Tiger’ again – Wilbur Ross’ (31.08.2011) link: https://www.theguardian.com/business/ireland-business-blog-with-lisa-ocarroll/2011/aug/31/ireland

Samson, Adam – ‘WL Ross in $14.1m settlement with US over fee disclosures’ (24.08.2016) link: https://www.ft.com/content/e8424f8f-5031-3d50-941b-a51ccaa07980

Security Exchange Commission – ‘Release No. 4494 / August 24, 2016 ADMINISTRATIVE PROCEEDING File No. 3-17491’ (24.08.2016)

Trump, Donald J. – ‘TRUMP PLEDGES TO DRAIN THE SWAMP AND IMPOSE CONGRESSIONAL TERM LIMITS’ (18.10.2016) link: https://www.donaldjtrump.com/press-releases/trump-pledges-to-drain-the-swamp